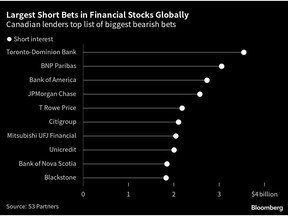

TD Bank biggest sector short anywhere in the world

Worries about TD’s exposure to Canada’s housing slowdown and ties to U.S. market

Article content

Turns out, the biggest short in the banking industry anywhere in the world isn’t in Switzerland or Silicon Valley, but rather, in the relatively tame financial centre of Canada.

Advertisement 2

Article content

In recent weeks, short sellers have upped their bearish bets against Toronto-Dominion Bank, and now have roughly US$3.7 billion on the line vis-à-vis Canada’s second-largest lender, according to an analysis by S3 Partners. That’s the most among financial institutions globally and puts TD ahead of the likes of France’s BNP Paribas SA and Bank of America Corp.

Article content

Part of it has to do with the general skittishness toward the banking sector after three U.S. regional banks failed and Credit Suisse was forced into a shotgun wedding with UBS Group AG. And there are few signs Canadian lenders have any of the liquidity issues that investors have zeroed-in on recently. But analysts also point to worries about TD’s exposure to the country’s housing slowdown, as well as its ties to the U.S. market through its stake in Charles Schwab Corp. and a planned regional bank acquisition.

Article content

Advertisement 3

Article content

“Short sellers have been actively shorting into a declining banking sector,” said Ihor Dusaniwsky, S3’s managing director of predictive analytics.

TD didn’t immediately respond to requests for comment from Bloomberg.

Granted, short interest as a percentage of TD’s shares available for trading, or float, remains relatively low at 3.3 per cent and up from 2.8 per cent a year ago. By that measure, TD is third among the top 20 U.S. and Canadian financial companies.

TD’s position atop the list of biggest bank shorts comes as it seeks to close a $13.4 billion deal for First Horizon Corp., which would expand its foothold in the U.S. TD is widely expected to renegotiate the deal after the recent bout of turmoil among U.S. regional banks drove share prices lower in March.

Advertisement 4

Article content

As a result, traders are “playing with short interest for TD more than normally” because the bank has become a merger arbitration play, according to Daneshvar Rohinton, a portfolio manager at Industrial Alliance.

Housing bubble

Rohinton says some short sellers also have zeroed-in on TD because of its roughly 10 per cent stake in Charles Schwab — which recently lost US$47 billion in market value as it came under scrutiny over its unrealized bond losses — as well as TD’s position in Canada’s housing market, where variable-rate mortgages are common and consumer insolvencies are on the rise.

-

Some TD shareholders urge bank to ditch or renegotiate First Horizon deal

-

Jamie Dimon says banking crisis not over yet with issues ‘hiding in plain sight’

-

Big Six Canadian banks make TSX a March loser as turmoil buffets index

Advertisement 5

Article content

“TD sits uniquely in the middle of two broad headwinds,” Rohinton said. “The fears around Canadian housing will be projected onto TD.”

So far, the TD short has been a winner. In March, shares of TD tumbled 11 per cent, which was the biggest decline in the S&P/TSX Banks Index. The decline wiped out $18.1 billion from the bank’s market value. Nevertheless, S3’s Dusaniwsky cautions that short-seller profits can evaporate just as fast, particularly when they are the result of a broad-based rally.

“Outsized short-selling like we saw in the banking sector are usually knee-jerk reactions to market turmoil and can reverse as quickly as they occur,” he said.

—With assistance from Alexandra Semenova.

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation