What Does Paratek Pharmaceuticals’ P/S Imply For Shareholders?

Paratek Pharmaceuticals, Inc. (NASDAQ:PRTK) shareholders would be thrilled to see that the share price tag has had a wonderful month, putting up a acquire and recovering from prior weakness. Getting a wider view, although not as solid as the previous thirty day period, the full year get of is also pretty sensible.

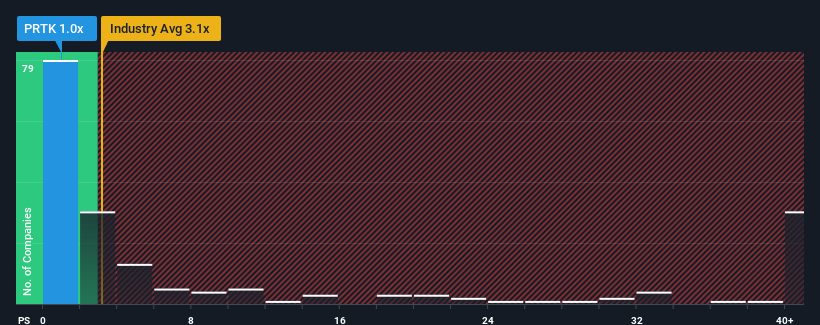

In spite of the agency bounce in price tag, Paratek Prescribed drugs may well still glimpse like a potent obtaining opportunity at existing with its value-to-revenue (or “P/S”) ratio of 1x, contemplating just about 50 percent of all businesses in the Prescribed drugs sector in the United States have P/S ratios increased than 3.1x and even P/S bigger than 15x usually are not out of the common. Nonetheless, we would need to have to dig a little deeper to establish if there is a rational basis for the remarkably minimized P/S.

Watch our hottest investigation for Paratek Prescribed drugs

What Does Paratek Pharmaceuticals’ P/S Imply For Shareholders?

Paratek Prescribed drugs surely has been doing a good work currently as it is really been expanding income additional than most other businesses. 1 likelihood is that the P/S ratio is low simply because traders imagine this potent income efficiency could possibly be significantly less spectacular going forward. If not, then current shareholders have cause to be very optimistic about the future route of the share price tag.

If you’d like to see what analysts are forecasting likely ahead, you ought to check out out our cost-free report on Paratek Prescription drugs.

Is There Any Profits Development Forecasted For Paratek Prescription drugs?

In order to justify its P/S ratio, Paratek Pharmaceuticals would will need to make anemic growth which is significantly trailing the sector.

If we evaluation the final yr of profits development, the enterprise posted a marvelous raise of 23{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b}. Spectacularly, a few 12 months revenue development has ballooned by a number of orders of magnitude, thanks in section to the last 12 months of profits advancement. Hence, it can be truthful to say the revenue progress recently has been fantastic for the organization.

Searching forward now, income is expected to climb by per yr throughout the coming 3 years according to the a few analysts next the enterprise. Which is shaping up to be materially decreased than the per annum development forecast for the broader sector.

With this in thing to consider, its obvious as to why Paratek Pharmaceuticals’ P/S is falling small sector friends. It appears most buyers are expecting to see minimal potential expansion and are only ready to pay a minimized amount for the stock.

What Does Paratek Pharmaceuticals’ P/S Necessarily mean For Investors?

Even just after this sort of a powerful value go, Paratek Pharmaceuticals’ P/S continue to trails the relaxation of the industry. Generally, we’d warning in opposition to reading through much too a great deal into cost-to-profits ratios when settling on financial commitment conclusions, nevertheless it can expose loads about what other market place individuals assume about the company.

As we suspected, our examination of Paratek Pharmaceuticals’ analyst forecasts unveiled that its inferior earnings outlook is contributing to its lower P/S. Shareholders’ pessimism on the income prospective clients for the company would seem to be the key contributor to the depressed P/S. The firm will want a transform of fortune to justify the P/S soaring better in the foreseeable future.

You should usually think about threats. Situation in place, we have noticed 4 warning indicators for Paratek Prescription drugs you ought to be informed of, and 3 of them are a little bit disagreeable.

If these risks are creating you reconsider your view on Paratek Pharmaceuticals, investigate our interactive list of superior excellent shares to get an plan of what else is out there.

Have suggestions on this posting? Involved about the content? Get in touch with us immediately. Alternatively, e mail editorial-team (at) simplywallst.com.

This posting by Just Wall St is standard in mother nature. We give commentary based on historical details and analyst forecasts only using an impartial methodology and our articles or blog posts are not meant to be financial information. It does not represent a suggestion to obtain or offer any inventory, and does not choose account of your targets, or your financial circumstance. We intention to carry you extensive-expression focused analysis pushed by basic knowledge. Take note that our evaluation could not element in the most current price tag-sensitive organization announcements or qualitative content. Simply Wall St has no place in any stocks outlined.

Be a part of A Compensated Person Analysis Session

You will get a US$30 Amazon Reward card for 1 hour of your time whilst supporting us develop superior investing resources for the individual traders like by yourself. Signal up in this article