Cavco Industries: Meeting The Evolving Needs Of The Housing Industry (NASDAQ:CVCO)

JARAMA/iStock via Getty Illustrations or photos

Thesis

Cavco Industries Inc. (NASDAQ: CVCO) is a major firm with fantastic keep track of file of profits and earnings growth. The corporation has reached organic expansion as a result of improving current operational performance and pursued strategic investments and acquisitions to expand their producing and retail presence. CVCO gross gain margin has been steadily raising above the many years and has a very good income stability to assist the enterprise long run acquisition ideas and share repurchases.

The management has been investing in the electronic platform, which can increase customers’ shopping experience and educating likely homebuyers on the value of made residences.

A blend of elements driving the recognition of created households – financial, social, demographic things, the appealing factors of a produced house, and the potentials in the untapped market place, this field is in a favorable placement and has advancement potentials.

With a sturdy management group and the extensive-expression development prospect, the enterprise is worth monitoring and to enter at a favourable value for the very long-term keep.

Corporation Overview

CVCO is a North American business that styles and manufactures manufacturing facility-created housing products and solutions, which includes made households, modular residences and park product RVs. It retails underneath numerous model names, together with Cavco Residences, Fleetwood Residences, and Palm Harbor Properties The corporation operates across the U.S., and has a powerful presence in the southwestern location.

In the most up-to-date FY2023 Q3 earnings get in touch with (Cavco Industries, Inc. Q3 2023 Earnings Call Transcript), EPS is $6.66, surpassing estimates by $.99. The enterprise has shipped earning surprises for the earlier 11 quarters.

CVCO’s solid functionality in modern yrs is because of to the powerful need for new properties in the U.S., pushed by scarcity of existing homes for sale and the have to have for affordable housing. Moreover, an growing older populace, 1st-time homebuyers, and low-revenue homes have also contributed to the greater demand.

The corporation has attained natural and organic expansion by way of bettering operational performance to boost profitability and ability utilization at their present amenities, expanded product or service offerings and successful gross sales methods. Around the yrs, they have also pursued strategic money allocation for acquisitions to expand their manufacturing existence with wonderful achievements. Acquisition will go on to be a progress method for the firm.

CVCO competes with other providers in the made and modular residence industry, including Skyline Winner (SKY), Legacy Housing Company (LEGH) and Clayton Houses (a subsidiary of Berkshire Hathaway).

As the housing field continues to evolve and reasonably priced housing will become essential, CVCO is founded and properly-positioned to cater to the switching requirements. I will elaborate down below on how CVCO can benefit and improve in the upcoming.

1. Modular housing is attaining popularity due to the fact of financial, social, and demographic components.

Modular housing has getting to be more well-known in the latest a long time due to its possible positive aspects more than traditional construction approaches, these kinds of as the velocity of building, affordability, and the ability to customise design. It is also pushed by a mixture of economic, social, and demographic variables, like an growing earnings inequality, an growing old populace and rapid urbanization.

According to a marketplace exploration report published by Extrapolate in February 2023 (World-wide Modular Development Sector and Design Chemical compounds Industry Dimension 2023, Modern Developments, Essential Improvements, Emerging Calls for, Prime Company Data, Hottest Technological innovation, and Potential Prospective clients Till 2032), the global Modular Design Market had a price of USD 101.3 billion in 2022, and it is anticipated to develop to USD 168.7 billion by 2032, with a CAGR of approximately 5.8{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} from 2023 to 2032.

One particular of the greatest rewards is the price efficiency. The expense for each square foot of made and modular residences is all over 10 to 20 p.c decrease than that of traditional web site-crafted properties (How A lot Are Modular Dwelling Costs?), therefore a excellent option for people in the facial area of the housing affordability hole.

During the FY2023 Q3 presentation, the management team reviewed the beneficial outcomes of their digital advertising and marketing initiatives. They highlighted how potential homebuyers can entry and discover a vast array of floor strategies – consisting of 1,500 made, modular, and park product choices – as properly as 2,700 inventory models underneath their flagship makes. This extensive assortment provides an prospect to educate homebuyers on the added benefits and eye-catching capabilities of made households.

Given the present economic circumstances, the interesting elements of a produced property, and the potentials in the untapped market place, the manufactured home market is in a favorable position and has the capacity to extend its reach to a larger audience.

2. Higher home finance loan curiosity rate may well evoke more calls for on reasonably priced housing.

Home loan desire level is 1 of the biggest factors for the homebuyers. Due to the perceived dangers related with modular construction and the limited resale market, modular residences usually obtaining slightly higher curiosity costs than the traditional homes. In excess of the several years, the interest charge spread in between the two has generally been stable.

Among 2022 and early 2023, the property finance loan rate has climbed tremendously, largely attributed to Fed’s charge hike to enable battle inflation. With the rate hikes, inflation is starting off to cool and many economic indicators remaining sturdy. Though the Fed may well start to simplicity some of the stress, and that there is a chance that home loan premiums may well reasonable, it is not likely that they will return to the low amounts seen through the pandemic. The better mortgage rate, in standard, might invoke extra needs on these value-economical modular housing.

Reiterating from the over, the manufactured and modular households can price about 10 to 20 per cent decrease than that of standard site-built houses. The management has also shared that they are supplying homebuyers the capability to access a wide selection of flooring ideas to choose what suits them ideal. This initiative can probably ease some of the value pressures related with buying a house and help homebuyers accomplish a much more manageable payment prepare for their desired household.

3. Powerful margins and financials make CVCO much better positioned to invest in advancement chances and value creation.

CVCO’s gross earnings margin has been progressively rising more than time, and this has been attributed, in section, to the efficient operational administration of the corporation. The crops have been ready to retain a large degree of efficiency, contributing to the in general advancement in the company’s profitability. The production volumes have been down in markets exactly where needs softened or retailer inventory de-stocking, which is offset by the improve in the average selling price per U.S. dwelling.

CVCO’s cash harmony is at $376 million, with $2 million in equally limited- and prolonged-time period personal debt. Money is largely built from their functions, with the CFO (TTM) at $248 million.

Nevertheless the enterprise does not fork out any dividend, CVCO does have a good cash balance and dollars generation potentials to make value for shareholders by means of strategic investments and share repurchase program.

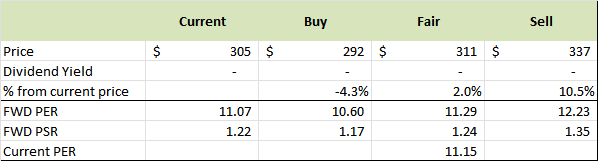

Valuation and feeling

My valuation for CVCO inventory is centered on CVCO’s money statement and earning forecast, and the facts is pushed by Searching for Alpha details. (Cavco Industries, Inc. Earnings Estimates)

Author’s monetary model

In today’s recent economic disorders and the will need for reasonably priced housing resolution, the made home market is in a favorable posture and has the prospective to reach to a larger sized audience. CVCO has been in the organization for just about 60 yrs and has expanded both organically and through strategic acquisition. Coupled with its spectacular financials standing and growth prospect, the firm is worth checking and to enter at a favourable rate for the extensive-time period hold.