Is Shapir Engineering and Industry (TLV:SPEN) Using Too Much Debt?

Some say volatility, alternatively than financial debt, is the best way to feel about threat as an trader, but Warren Buffett famously stated that ‘Volatility is much from synonymous with possibility.’ It is only all-natural to think about a company’s balance sheet when you study how risky it is, considering the fact that personal debt is usually concerned when a business collapses. We be aware that Shapir Engineering and Business Ltd (TLV:SPEN) does have personal debt on its harmony sheet. But should shareholders be nervous about its use of financial debt?

When Is Financial debt A Dilemma?

Debt is a resource to help firms expand, but if a company is incapable of having to pay off its creditors, then it exists at their mercy. In the worst circumstance circumstance, a corporation can go bankrupt if it can’t fork out its creditors. Although that is not way too popular, we generally do see indebted corporations forever diluting shareholders due to the fact creditors drive them to raise funds at a distressed selling price. Of study course, lots of companies use credit card debt to fund expansion, with no any detrimental effects. The initially step when thinking of a company’s debt levels is to think about its cash and credit card debt collectively.

Look at out our most up-to-date examination for Shapir Engineering and Industry

What Is Shapir Engineering and Industry’s Internet Financial debt?

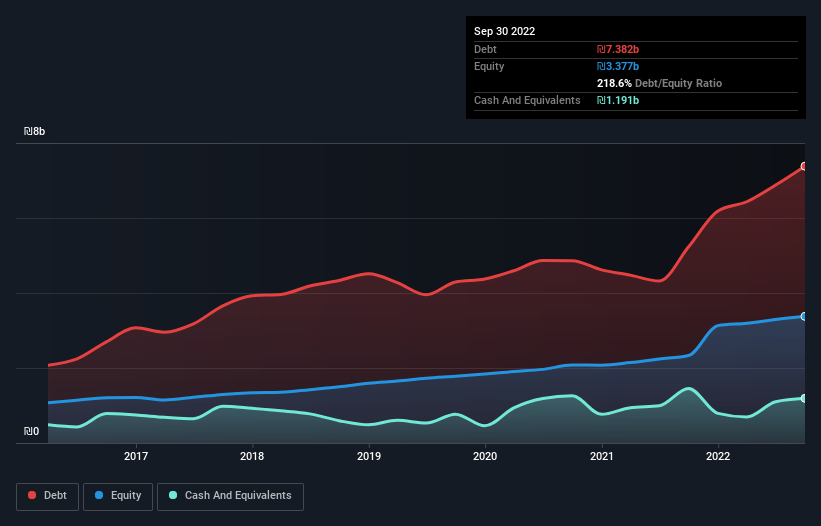

As you can see under, at the close of September 2022, Shapir Engineering and Sector experienced ₪7.38b of credit card debt, up from ₪5.23b a year back. Simply click the graphic for a lot more depth. On the flip aspect, it has ₪1.19b in income primary to internet credit card debt of about ₪6.19b.

How Healthful Is Shapir Engineering and Industry’s Equilibrium Sheet?

Zooming in on the latest harmony sheet info, we can see that Shapir Engineering and Market experienced liabilities of ₪3.13b due inside 12 months and liabilities of ₪6.95b thanks beyond that. Offsetting these obligations, it experienced income of ₪1.19b as very well as receivables valued at ₪1.91b owing in just 12 months. So its liabilities full ₪6.98b much more than the mix of its money and shorter-time period receivables.

This is a mountain of leverage relative to its industry capitalization of ₪9.46b. This implies shareholders would be greatly diluted if the organization required to shore up its harmony sheet in a hurry.

In purchase to sizing up a company’s credit card debt relative to its earnings, we work out its internet debt divided by its earnings right before curiosity, tax, depreciation, and amortization (EBITDA) and its earnings in advance of curiosity and tax (EBIT) divided by its curiosity expense (its desire include). This way, we think about the two the absolute quantum of the debt, as well as the desire charges compensated on it.

Shapir Engineering and Marketplace shareholders deal with the double whammy of a high web financial debt to EBITDA ratio (9.1), and reasonably weak interest coverage, since EBIT is just 1.8 periods the fascination expense. This implies we’d take into account it to have a significant financial debt load. Even more troubling is the truth that Shapir Engineering and Field essentially enable its EBIT lower by 5.7{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} about the past year. If it retains heading like that paying off its credit card debt will be like functioning on a treadmill — a ton of effort and hard work for not a lot improvement. When analysing debt ranges, the stability sheet is the obvious position to commence. But it is Shapir Engineering and Industry’s earnings that will affect how the equilibrium sheet holds up in the long run. So when taking into consideration debt, it truly is unquestionably truly worth wanting at the earnings craze. Click listed here for an interactive snapshot.

But our closing consideration is also significant, for the reason that a company cannot pay back credit card debt with paper income it desires cold challenging funds. So the logical move is to appear at the proportion of that EBIT that is matched by real totally free hard cash circulation. In the past a few decades, Shapir Engineering and Field created no cost money circulation amounting to 7.5{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} of its EBIT, an uninspiring overall performance. For us, income conversion that lower sparks a small paranoia about is capacity to extinguish financial debt.

Our Look at

On the confront of it, Shapir Engineering and Industry’s desire protect left us tentative about the inventory, and its web financial debt to EBITDA was no much more attractive than the one vacant restaurant on the busiest night of the year. And moreover, its stage of overall liabilities also fails to instill self-confidence. We’re pretty obvious that we consider Shapir Engineering and Sector to be really fairly risky, as a consequence of its equilibrium sheet well being. So we’re just about as wary of this stock as a hungry kitten is about falling into its owner’s fish pond: the moment bitten, twice shy, as they say. When analysing credit card debt levels, the stability sheet is the noticeable put to start off. But in the long run, every single business can have challenges that exist outside the house of the equilibrium sheet. We have identified 2 warning signals with Shapir Engineering and Field (at least 1 which is sizeable) , and knowledge them ought to be component of your financial investment process.

At the conclude of the working day, it is really usually greater to focus on corporations that are no cost from internet financial debt. You can obtain our unique checklist of these types of corporations (all with a track record of earnings development). It really is absolutely free.

Valuation is sophisticated, but we’re encouraging make it uncomplicated.

Uncover out whether or not Shapir Engineering and Marketplace is perhaps more than or undervalued by examining out our extensive analysis, which involves honest benefit estimates, hazards and warnings, dividends, insider transactions and financial health and fitness.

Watch the Totally free Investigation

Have opinions on this report? Concerned about the information? Get in touch with us specifically. Alternatively, e mail editorial-team (at) simplywallst.com.

This post by Simply Wall St is normal in mother nature. We provide commentary centered on historic facts and analyst forecasts only applying an impartial methodology and our posts are not supposed to be financial tips. It does not constitute a suggestion to acquire or sell any inventory, and does not take account of your aims, or your fiscal predicament. We intention to carry you very long-phrase concentrated evaluation pushed by basic knowledge. Take note that our analysis could not issue in the latest cost-sensitive company announcements or qualitative content. Simply Wall St has no place in any stocks described.