4 Promising Stocks From a Challenging Outpatient Home Health Industry

The pandemic altered the nature and dynamics of the healthcare industry. The Zacks Medical – Outpatient and Home Healthcare industry bore the brunt of lower outpatient clinic visits and struggled to provide quality care with respect to home healthcare due to the risk of exposure to the virus as well as the record level of staffing shortages. In recent times, although the severity of the infection has declined, there has been a circulation of a mixture of respiratory viruses per a recently-published data published by the Centers for Disease Control and Prevention. Apart from the respiratory ailments, the U.S. healthcare system is also currently being bothered by the recent increasing threat of spread of the antimicrobial resistant fungus — Candida auris (C. auris) — in healthcare facilities. Another concern plaguing the U.S. healthcare system is the persistent cost inflation and supply-chain constraints. These are consistently pushing up the operating costs of the healthcare industry, thereby lowering the margins of industry players.

On a positive note, rising dependence on telehealth and artificial intelligence (AI) is likely to help the industry thrive in the near term. Chemed Corporation CHE, Addus HomeCare Corporation ADUS, RadNet, Inc. RDNT and The Pennant Group, Inc. PNTG are likely to gain from the prospects.

Industry Description

The industry comprises companies that offer ambulatory care in an outpatient setting or at home. These companies use advanced medical technologies for diagnosis, observation, consultation, treatment and rehabilitation services. The industry participants also include operators of HMO medical centers, kidney dialysis centers, freestanding ambulatory surgical units, emergency centers and other outpatient care centers. Some of the companies in this space have been at the forefront of the COVID-19 pandemic response since 2020 by expanding access to laboratory insights to enable people to lead healthier and safer lives through both molecular diagnostic and antibody serology tests. These tests help in the diagnosis of COVID-19 and the identification of immune response to the virus.

Major Trends Shaping the Future of the Outpatient and Home Healthcare Industry

Cost Effectiveness: The primary advantage of outpatient clinics is cost-effectiveness. Outpatient medical care clinics do not retain patients for long hours (overnight) or charge exorbitantly. Notably, modern-day outpatient clinics offer a broad spectrum of treatment and diagnostic options and even minor surgical procedures. Financial incentives like health plans and government program payment policies supporting services in lower-cost care settings have also been driving outpatient care. In fact, this is the primary reason why middle-class Americans, making up more than 62{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} of the total population, prefer outpatient clinic visits.

Participating in Alternative Payment Models: It only seems reasonable for outpatient clinics to shift from fee-for-service (FFS) to alternative payment models (APM) with shared savings, risk, bundled payments or population-based payments. With value-based models of care steadily emerging as the future of healthcare, this shift is an ongoing parallel trend. FFS will be crucial to care organizations as a benchmark by which providers can assess alternative payment models. By obtaining the payment schedule from payers and comparing it to the organization’s FFS reimbursements from the same payer, providers can ascertain APM that would be financially the most advantageous to its operation.

AI’s Dominant Role: AI has been a roaring success in healthcare. It is no wonder that it has taken the outpatient and home healthcare space by storm. Outpatient companies prefer bots and automated techniques for managing health information. With the help of AI, hospitals have been achieving better outcomes, with patients receiving more efficient and personalized care. The outpatient industry has been generating huge profits from Electronic Health Records, Revenue Cycle Management, eLabs and ePrescriptions.

In recent times, healthcare facilities are experimenting with software designed to help doctors automatically generate notes from conversations with patients. Microsoft, in its official blog, has confirmed that it (along with Nuance) is introducing a solution — Dragon Ambient eXperience (DAX) Express. It is an automated clinical documentation application integrated into the workflow that combines proven conversational and ambient AI with advanced reasoning and natural language capabilities of OpenAI’s GPT-4.

Increased Dependence on Telehealth: The pandemic resulted in a decline in outpatient clinic visits. Home healthcare providers struggled to offer quality care due to the risk of exposure to the virus. Though the impact of the pandemic has been far-reaching, it has accelerated healthcare innovation. Visits to outpatient clinics have been witnessing a noticeable rebound, with the majority of people being vaccinated. But there are patients who want to be cautious and are resorting to telehealth. Meanwhile, home healthcare can gain from the benefits provided by Medicare (and several other payers) that comprises a broad range of services that can be delivered in a patient’s home, including post-operative and chronic wound care, rehabilitation, and physical therapy. These services serve as lifelines for vulnerable patients, including the Medicare population, suffering from complications arising from COVID-19. Moreover, home healthcare has seen a surge in the utilization of the telehealth platform in response to the pandemic.

A notable trend that has been emerging in this respect is the increasing popularity of the hybrid mode of treatment. As there are certain chronic health conditions, which cannot be identified over a telephone or video call, patients are embracing the hybrid mode of seeking treatments from their physicians in these cases.

Prominent Role of Remote Patient Monitoring: Remote patient monitoring (RPM) has been gradually gaining ground since the pandemic. During that phase, it was difficult to keep a watch on non-COVID patients in the hospital care setting as hospital capacities were brimming with COVID-19 patients. Thus, non-critical patients were increasingly being provided with healthcare in the comfort of their homes while being remotely monitored by their care providers. Even with the return to normalcy, patients are increasingly preferring to be monitored from their homes via RPM devices. This is also boosting home healthcare services as vulnerable patients can be safely and adequately cared from the home setting instead of hospital settings, where the risk of COVID-19 or other infections persists.

Zacks Industry Rank

The Zacks Medical – Outpatient and Home Healthcare industry falls within the broader Zacks Medical sector. It carries a Zacks Industry Rank #156, which places it in the bottom 38{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} of nearly 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bleak near-term prospects. Our research shows that the top 50{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} of the Zacks-ranked industries outperforms the bottom 50{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} by a factor of more than 2 to 1.

Before we present a few outpatient home health stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

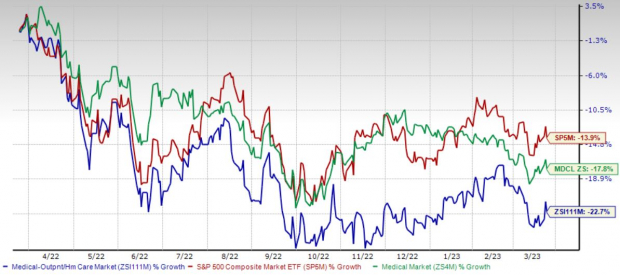

Industry’s Stock Market Performance

The industry has underperformed both its sector and the Zacks S&P 500 composite in the past year.

The industry has declined 22.8{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} over this period compared with the S&P 500’s decline of 13.9{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b}. The broader sector has declined 17.8{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} in the same time frame.

One Year Price Performance

Image Source: Zacks Investment Research

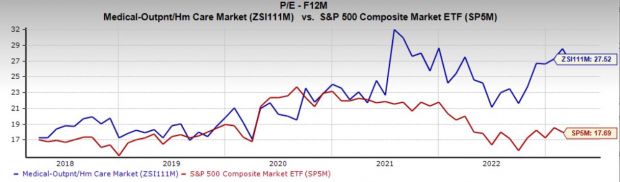

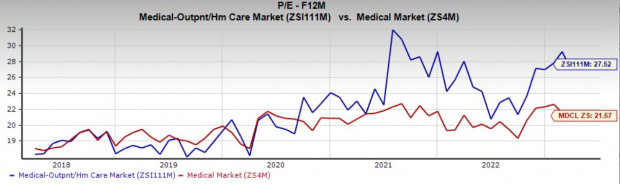

Industry’s Current Valuation

On the basis of the forward 12-month price-to-earnings (P/E), which is commonly used for valuing medical stocks, the industry is currently trading at 27.5X compared with the S&P 500’s 17.7X and the sector’s 21.6X.

Over the last five years, the industry has traded as high as 31.5X and as low as 16.8X, with the median being at 21.7X, as the charts below show.

Price-to-Earnings Forward Twelve Months (F12M)

Image Source: Zacks Investment Research

Price-to-Earnings Forward Twelve Months (F12M)

Image Source: Zacks Investment Research

4 Promising Outpatient and Home Healthcare Stocks

Chemed: The company operates through two wholly owned subsidiaries — VITAS Healthcare Corporation (a renowned provider of end-of-life care) and Roto-Rooter (a well-known commercial and residential plumbing and drain cleaning services provider). Chemed announced its fourth-quarter 2022 results last month, wherein it registered an uptick in its overall revenues. It also recorded robust reported sales in its Roto-Rooter business, wherein the total Roto-Rooter branch commercial revenues improved 8.7{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} from last year on a 5.5{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} increase in drain cleaning revenues, a 13.8{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} rise in commercial plumbing, 5.1{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} growth in excavation revenues and a 27.3{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} hike in commercial water restoration revenues. CHE carries a Zacks Rank of 2 (Buy).

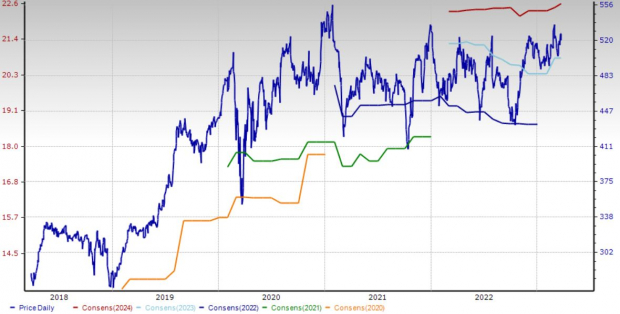

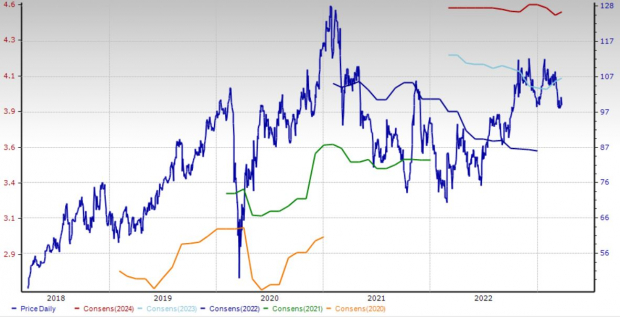

Price and Consensus: CHE

Image Source: Zacks Investment Research

For this company, the Zacks Consensus Estimate for 2023 revenues suggests growth of 4.7{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b}. The same for earnings indicates an increase of 5.6{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b}. The company’s return on equity (ROE) of 41.5{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} compares favorably with the industry’s 6.4{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b}.

Addus HomeCare: Its services and operating model address a number of crucial needs across the healthcare continuum. Last month, Addus HomeCare announced its fourth-quarter 2022 results, where it registered a solid uptick in its net service revenues. Management confirmed that its personal care revenues (accounting for 74.2{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} of overall revenue) improved year over year on a same-store basis, reflecting steady volume growth trends. Home health revenues, which included the operations of Armada Home Health and Summit Home Health acquired in 2021, and the addition of Apple Home Healthcare operations effective Oct 1, 2022, were also up year over year on a same-store basis. ADUS carries a Zacks Rank of 2.

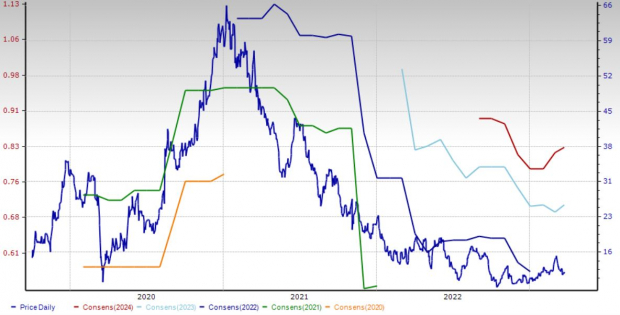

Price and Consensus: ADUS

Image Source: Zacks Investment Research

For this company, the Zacks Consensus Estimate for 2023 revenues suggests growth of 8.2{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b}. The same for earnings indicates an increase of 9.4{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b}. The company’s ROE of 8.6{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} compares favorably with the industry’s 6.4{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b}.

RadNet: It is a renowned provider of fixed-site outpatient diagnostic imaging services through a network of owned and/or operated outpatient imaging centers. Last month, RadNet announced its fourth-quarter 2022 results, where it registered a solid uptick in its net revenues, both including and excluding revenues from the AI reporting segment. The company’s aggregate procedural volumes and same-center procedural volumes also increased year over year in the reported quarter. On the back of its performance in the fourth quarter of 2022, management is optimistic about its financial position and operating model, which has presented RadNet with targeted opportunities to expand its business, particularly through the construction of new centers to meet growing demand and utilization in strategic markets. RDNT carries a Zacks Rank of 2.

Price and Consensus: RDNT

Image Source: Zacks Investment Research

For this Los Angeles, CA-based company, the Zacks Consensus Estimate for 2023 revenues suggests growth of 9.6{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b}. The same for earnings indicates an increase of 70{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b}. The company’s P/CF ratio of 6.6 compares favorably with the industry’s 9.4.

The Pennant Group: It is the parent company of the Pennant group of affiliated home health, hospice and senior living companies. This month, The Pennant Group completed the acquisition of operations of Robins Landing at New Berlin, WI and Robins Landing at Brookfield, WI. Last month, it reported its fourth-quarter 2022 results, where it witnessed solid improvement in its overall top line. Its Home Health and Hospice Services segment recorded a robust uptick in revenues, whereas the company also recorded strength in its total home health admissions and total Medicare home health admissions. The uptick in total hospice admissions, Senior Living Services segment and Same store Senior Living Services segment for the fourth quarter was also impressive. PNTG carries a Zacks Rank of 2.

Price and Consensus: PNTG

Image Source: Zacks Investment Research

For this Eagle, ID-based company, the Zacks Consensus Estimate for 2023 revenues suggests growth of 8.4{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b}. The same for earnings indicates an increase of 24.6{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b}. The company’s ROE of 12.4{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} compares favorably with the industry’s 6.4{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b}.

Is THIS the Ultimate New Clean Energy Source? (4 Ways to Profit)

The world is increasingly focused on eliminating fossil fuels and ramping up use of renewable, clean energy sources. Hydrogen fuel cells, powered by the most abundant substance in the universe, could provide an unlimited amount of ultra-clean energy for multiple industries.

Our urgent special report reveals 4 hydrogen stocks primed for big gains – plus our other top clean energy stocks.

Chemed Corporation (CHE) : Free Stock Analysis Report

Addus HomeCare Corporation (ADUS) : Free Stock Analysis Report

RadNet, Inc. (RDNT) : Free Stock Analysis Report

The Pennant Group, Inc. (PNTG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.