Nafpaktos Textile Industry (ATH:NAYP) Is Looking To Continue Growing Its Returns On Capital

There are a few key developments to seem for if we want to determine the subsequent multi-bagger. Ideally, a enterprise will show two tendencies firstly a developing return on funds utilized (ROCE) and secondly, an growing total of cash used. Generally this implies that a company has profitable initiatives that it can keep on to reinvest in, which is a trait of a compounding equipment. With that in thoughts, we’ve noticed some promising traits at Nafpaktos Textile Sector (ATH:NAYP) so let us glance a bit further.

Return On Money Employed (ROCE): What Is It?

If you haven’t labored with ROCE in advance of, it actions the ‘return’ (pre-tax revenue) a firm generates from money utilized in its organization. To calculate this metric for Nafpaktos Textile Marketplace, this is the formula:

Return on Cash Used = Earnings Before Fascination and Tax (EBIT) ÷ (Overall Assets – Present Liabilities)

.14 = €2.3m ÷ (€21m – €3.9m) (Primarily based on the trailing twelve months to June 2022).

As a result, Nafpaktos Textile Sector has an ROCE of 14{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b}. Which is a rather common return and it’s in line with the business ordinary of 14{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b}.

Perspective our most recent evaluation for Nafpaktos Textile Field

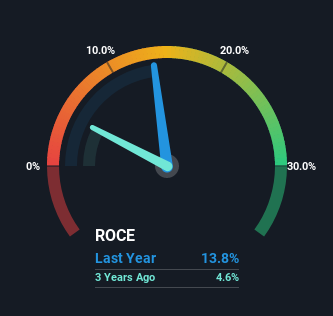

Historical overall performance is a good spot to start when investigating a inventory so earlier mentioned you can see the gauge for Nafpaktos Textile Industry’s ROCE versus it is prior returns. If you want to delve into the historic earnings, revenue and cash flow of Nafpaktos Textile Sector, check out these totally free graphs here.

What Can We Tell From Nafpaktos Textile Industry’s ROCE Development?

Traders would be delighted with what is actually going on at Nafpaktos Textile Sector. Over the very last 5 yrs, returns on cash utilized have risen substantially to 14{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b}. Essentially the business enterprise is earning extra for each dollar of funds invested and in addition to that, 75{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} much more cash is currently being used now too. So we are quite a lot inspired by what we’re viewing at Nafpaktos Textile Field thanks to its means to profitably reinvest funds.

In Summary…

All in all, it truly is terrific to see that Nafpaktos Textile Industry is reaping the rewards from prior investments and is expanding its funds foundation. And with the inventory obtaining done extremely effectively over the previous 5 decades, these designs are remaining accounted for by investors. So given the inventory has demonstrated it has promising trends, it is really truly worth investigating the enterprise additional to see if these trends are possible to persist.

Nafpaktos Textile Market does appear with some pitfalls although, we uncovered 3 warning signs in our investment investigation, and 1 of individuals does not sit much too nicely with us…

For individuals who like to spend in stable corporations, verify out this free of charge listing of corporations with stable equilibrium sheets and superior returns on fairness.

Valuation is intricate, but we are assisting make it basic.

Discover out no matter whether Nafpaktos Textile Marketplace is most likely in excess of or undervalued by examining out our extensive examination, which incorporates honest benefit estimates, pitfalls and warnings, dividends, insider transactions and financial well being.

See the Free of charge Investigation

Have opinions on this article? Involved about the articles? Get in contact with us directly. Alternatively, electronic mail editorial-staff (at) simplywallst.com.

This short article by Merely Wall St is normal in character. We present commentary centered on historic data and analyst forecasts only using an impartial methodology and our posts are not meant to be financial advice. It does not represent a recommendation to buy or market any inventory, and does not acquire account of your objectives, or your economic scenario. We intention to convey you lengthy-phrase focused assessment driven by fundamental facts. Note that our examination may possibly not factor in the most current value-delicate enterprise bulletins or qualitative material. Simply just Wall St has no place in any stocks talked about.