Be Wary Of Shapir Engineering and Industry (TLV:SPEN) And Its Returns On Capital

To obtain a multi-bagger inventory, what are the underlying trends we really should seem for in a company? In a excellent environment, we’d like to see a firm investing additional capital into its company and preferably the returns acquired from that cash are also escalating. Put just, these styles of companies are compounding devices, that means they are continuously reinvesting their earnings at ever-higher premiums of return. In light-weight of that, when we appeared at Shapir Engineering and Industry (TLV:SPEN) and its ROCE trend, we were not specifically thrilled.

What Is Return On Funds Employed (ROCE)?

For these that aren’t certain what ROCE is, it steps the amount of money of pre-tax revenue a corporation can make from the capital utilized in its enterprise. To work out this metric for Shapir Engineering and Industry, this is the method:

Return on Money Employed = Earnings Before Curiosity and Tax (EBIT) ÷ (Overall Assets – Present-day Liabilities)

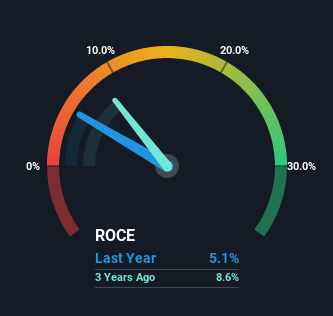

.051 = ₪524m ÷ (₪13b – ₪3.1b) (Dependent on the trailing twelve months to September 2022).

Thus, Shapir Engineering and Business has an ROCE of 5.1{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b}. In complete phrases, that’s a minimal return and it also less than-performs the Building market normal of 6.8{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b}.

See our most up-to-date evaluation for Shapir Engineering and Field

Whilst the earlier is not agent of the future, it can be beneficial to know how a enterprise has executed historically, which is why we have this chart above. If you’re intrigued in investigating Shapir Engineering and Industry’s earlier further, verify out this no cost graph of previous earnings, income and dollars movement.

So How Is Shapir Engineering and Industry’s ROCE Trending?

On the area, the craze of ROCE at Shapir Engineering and Industry will not encourage confidence. Above the previous 5 many years, returns on money have lowered to 5.1{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} from 9.2{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} five years ago. On the other hand it appears to be like like Shapir Engineering and Marketplace may be reinvesting for prolonged phrase growth because when capital utilized has increased, the firm’s revenue have not modified considerably in the past 12 months. It is worthy of trying to keep an eye on the company’s earnings from in this article on to see if these investments do conclude up contributing to the bottom line.

What We Can Learn From Shapir Engineering and Industry’s ROCE

In summary, Shapir Engineering and Sector is reinvesting money back into the organization for development but regrettably it appears to be like product sales haven’t greater considerably just still. Investors ought to imagine there’s superior matters to arrive for the reason that the inventory has knocked it out of the park, providing a 102{1668a97e7bfe6d80c144078b89af180f360665b4ea188e6054b2f93f7302966b} obtain to shareholders who have held above the previous five many years. In the end, if the fundamental tendencies persist, we wouldn’t hold our breath on it staying a multi-bagger heading ahead.

One particular a lot more detail: We’ve determined 2 warning signals with Shapir Engineering and Field (at the very least 1 which would make us a little bit unpleasant) , and comprehending them would absolutely be valuable.

For people who like to spend in stable businesses, check out this free of charge list of corporations with sound harmony sheets and substantial returns on fairness.

Valuation is complicated, but we are assisting make it simple.

Uncover out no matter if Shapir Engineering and Marketplace is perhaps above or undervalued by checking out our detailed assessment, which features honest benefit estimates, threats and warnings, dividends, insider transactions and economical wellness.

Perspective the Free of charge Examination

Have comments on this write-up? Worried about the information? Get in contact with us instantly. Alternatively, e-mail editorial-crew (at) simplywallst.com.

This report by Simply Wall St is standard in character. We present commentary primarily based on historical info and analyst forecasts only working with an impartial methodology and our articles are not meant to be economical assistance. It does not represent a advice to acquire or provide any inventory, and does not just take account of your aims, or your fiscal problem. We goal to bring you very long-phrase centered assessment pushed by basic details. Observe that our analysis may well not issue in the most recent value-delicate company announcements or qualitative product. Simply Wall St has no place in any stocks stated.